It’s the iPhone 6 Plus for me…I think

After a few chats with AT&T and Apple online reps, some spreadsheet work to examine the costs, and much thinking, I've believe I've figured out how I'm going to order my iPhone 6 at 12:00am Pacific time tomorrow morning. Here's what I'm going to do…

After a few chats with AT&T and Apple online reps, some spreadsheet work to examine the costs, and much thinking, I've believe I've figured out how I'm going to order my iPhone 6 at 12:00am Pacific time tomorrow morning. Here's what I'm going to do…

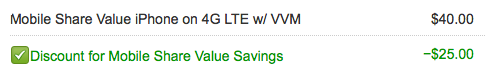

I'm going to order the "contract free" 64GB iPhone 6 Plus directly from Apple. The phone is listed as "T-Mobile," but after chatting with Apple and AT&T reps, and hearing from people in the Twitterverse, it seems this will be usable on AT&T with a simple SIM card swap at the local AT&T store. And buying it off contract means I can keep my AT&T discount, as discussed in the above-linked article.

Update: Based on some comments on this article, I've changed my mind: I'm going to try AT&T Next 12. It can be paid off early without penalty, the total cost over two years is the same as buying up front, you still get the $25 monthly discount, and you save the up-front cost.

Why buy directly from Apple, and why choose the monstrous 6 Plus?

Why buy directly from Apple, and why choose the monstrous 6 Plus?

The Apple bit is simple: it's due to their friendly 14 day return policy. (I've also confirmed they'll take back an activated phone without any issues.) AT&T offers a return program, too, but there's a potential restocking fee for opened devices.

Buying from Apple gives me the chance to test the monster phone in my hands for a week or so before deciding if it's right for me. I've been "testing" this week with the cardboard-and-coin monstrosity seen at right. Somehow, it's not quite the same—though I think the call quality is a touch better than on my real iPhone badda-bing. I really need to have the beast with me for a week to see how it goes.

Why did I choose to start with the monster phone? First, because I'm really interested in the optical image stabilization feature, and want to see how it works in real life. Second, because I tend to think the Plus might be the rarer of the two phones, therefore harder to get if I do decide to do an exchange in a couple weeks. Finally, it's the most-different device from my current phone—if I'm going to make a change to something bigger, I might as well start with the really big one.

Of course, I may change my mind at 11:59pm tonight, and start with the smaller Six, with the option to return and replace for the Plus. I figure I've got about eight hours left with my two cardboard stand-ins (yes, I made one for the regular Six, too) before I have to make up my mind!

Back in mid-1993, I was working as a Financial Analyst for Apple in Cupertino; I'd been there for a few years, and had recently taken on a new role with a group called

Back in mid-1993, I was working as a Financial Analyst for Apple in Cupertino; I'd been there for a few years, and had recently taken on a new role with a group called  All (or as many as could be found online) of my 2013 writings for Macworld.

All (or as many as could be found online) of my 2013 writings for Macworld.