The coming of "not without compromise" 32bit app usage in the fall 2018 macOS release finally forced my hand: I was going to have to update my single longest-used app, Quicken 2007. I've been using Quicken in some form since 1994, but stopped with Quicken 2007—I found the newer versions worse than Quicken 2007, so I never upgraded.

Yes, I was using an eleven-year-old app to track our family's spending and investments. Why? Basically because it worked (most of the time), and I didn't like any of the alternatives, which I would occasionally test. But Quicken 2007 was showing its age. In addition to its 32bitness, it had other issues: The UI was tiny and horrid, the windows never opened where I closed them (Moom's saved layouts to the rescue!), and online access to my accounts was nearly non-existent. Worst of all, it would crash on occasion, necessitating rebuilding all my data files. It was finally time to find its replacement.

After reviewing lists of alternatives—and asking on Twitter—I focused on three apps: Bantivity, Moneydance, and Quicken 2018 for Mac.

After looking at all three, I surprised myself by deciding that Quicken was the best tool for our use. Going in, I was dead set against it, mainly due to its annual subscription structure. (I hate subscription software in general, but as it turns out, this one isn't really a subscription.)

Read on for brief overviews of each of these three apps (with more detail on Quicken) and my rationale for deciding on Quicken.

Getting started

I was looking for an app that…

- Imported our historical Quicken data I didn't want to lose 24+ years of our financial data.

- Felt like a Mac app I wasn't interested in something that felt like a port from Windows, or lacked the specific "Macness" one gets in an app written for the Mac.M

- Offered accurate investment tracking Our investments are in a few accounts, and I like to monitor them all in one spot.

- Included online account access I want to update our bank, credit card, and investment accounts from the source, instead of having to manually enter transactions.

Things I don't really care about are bill pay (I use our bank), reports, budgets, and charts and graphs for anything outside the investments section of the app. As such, I can't vouch for how well any of these three programs handle those tasks.

All three apps imported my Quicken data file, though with varying degrees of success. Moneydance ignored the "hidden" status of accounts, so a lot of old, closed accounts showed up. Banktivity won't import reconciliations, so none of my accounts were reconciled. Still, these are relatively minor issues compared to successfully importing nearly 25 years worth of Quicken data.

Now, here's a brief overview of each of the three apps…

3 - Moneydance

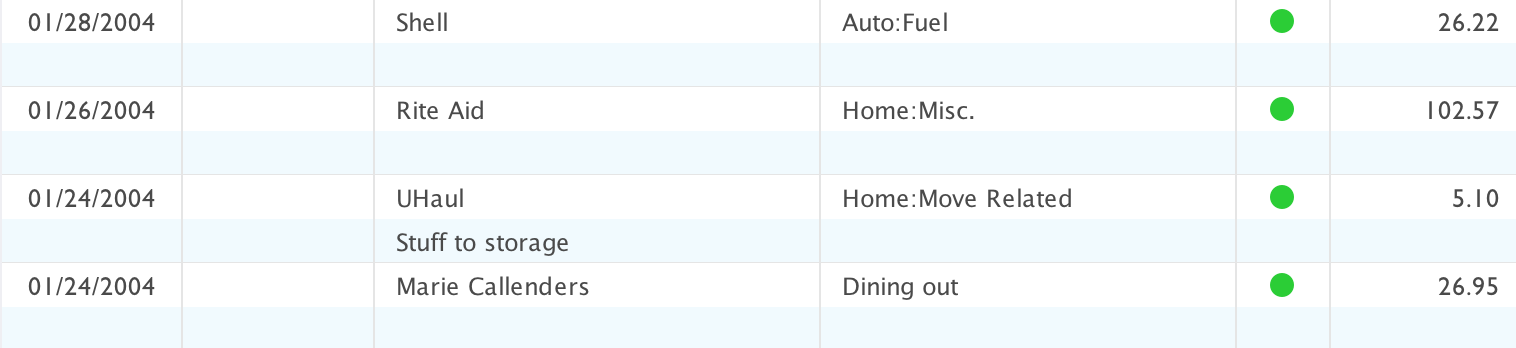

This was the first app I looked at, and I pretty quickly ruled it out. I found the interface not to my liking—there are icons next to each account, which makes the layout look busy, and I found its register view confusing:

Notice that entries take up two rows, but the white/blue background alternates every other row…so if you're glancing at the register, it's nearly impossible to pick out one transaction unless you click on it to select it. (It's easy to tell them apart in this four-line partial register, but in the full register with comments on the second line for many entries, everything blends together.)

Moneydance is a Java app. And while that doesn't inherently make it bad, Java's generic "write once for many platforms" code shows itself in a few places: The Preferences window doesn't look anything like a native Mac app window, and the buttons in the app are definitely not macOS-style buttons. Performance-wise, the app feels a bit slow; it takes a couple of seconds to open an account in a new window after double-clicking its entry in the account list. This is true even if it's an account I just opened and then closed.

Due to these issues, I quickly decided that Moneydance was not for me.

2 - Banktivity

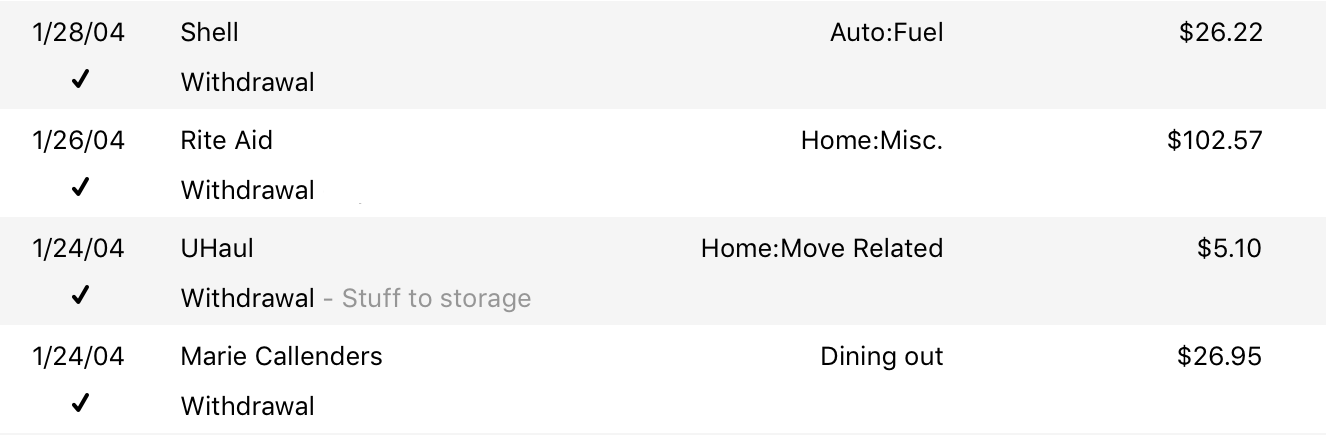

Banktivity was a strong contender; it was neck and neck with Quicken until I got more into the transition and looked closely at all of our accounts. Its account list view is also laden with icons—folder icons, new activity count badges, and status badges. It looks very busy, but once you get into an account, the view is much cleaner than Moneydance:

This view can also be infested with icons, but those can (thankfully) be disabled in the app's preferences. In the register view, each entry is two rows, but the alternating background is also two rows, making it easy to see each transaction at a glance.

Banktivity has two methods of data download: OFX (free) and Direct Access (subscription required). While many of our accounts offered free OFX support, there were a number that only worked with Direct Access, which is free during the generous 30 day trial period. Outside of that, Direct Access is a $45 per year subscription.

Banktivity doesn't have any of the "non-native" issues I found in Moneydance; the app looks and feels like a traditional Mac app, and opening an account window from the account list is speedy. Unfortunately, you can't do that with a double-click, as that brings up the account's info panel; you need to right-click and choose Open in New Window from the contextual menu. That's a big time waster for me.

On the investment side, I had issues with two stocks that had had stock splits. Because I wasn't downloading investment data in Quicken 2007, I had manually entered the splits using Quicken's split tool. Banktivity didn't handle this correctly, so our balances were way off in those two accounts.

In the end, I decided against using Banktivity due to its cost ($65 up front, plus $45 per year), the overabundance of icons in the layouts, its inability to import reconciliations from Quicken, and its difficulties handling some investment data.

1 - Quicken 2018

When Quicken 2018 was released as a subscription product, I tweeted my displeasure with the change, as I have a big issue with "software as a service." But as I dug into the app, I discovered that their subscription isn't really a subscription: If you stop subscribing, you can still use the app to enter and track financial data; you just lose access to the online components and Quicken's support services. That allayed my fears of needing to subscribe forever, just so I wouldn't lose access to my financial data.

Unfortunately, there's no free trial of Quicken, but they do offer a 30-day money back guarantee, so I paid and started testing.

What I found is an app that, for the most part, takes everything I liked about Quicken 2007 and modernizes it. As I hoped, Quicken handled the import of my old data perfectly, bringing across the reconciliations and handling investments properly. It's also speedy, opening new account windows promptly when double-clicked.

I like the minimalist one-line register views—they're clean and easy to read:

(If you need to see the details, you can double-click to see an expanded view.)

You can choose one of four levels of line spacing for the register—they include Comfortable, Cozy (pictured), Compact, and Tiny. None of these affect the font size, just the row spacing. (I wish the font size were changeable, but it's not.)

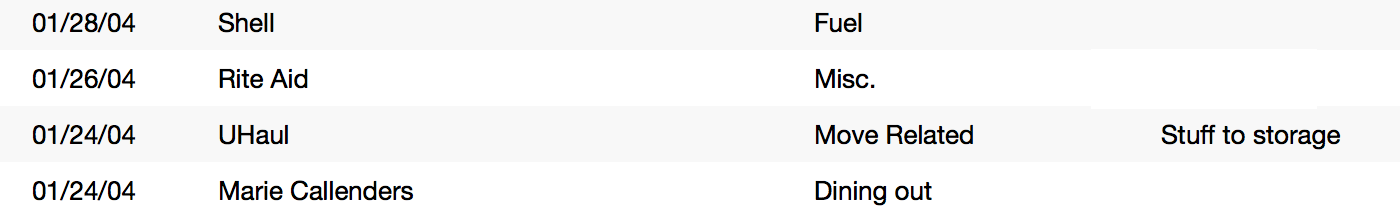

Unique to Quicken among these three apps is the ability to change the visible columns, as well as the column order, on a per-register basis.

Unique to Quicken among these three apps is the ability to change the visible columns, as well as the column order, on a per-register basis.

As seen at right, there are a large number of columns you can choose to view—24 in total. I like that it's just as easy to hide columns you don't want to see. Once you've added and removed columns to your liking, you can drag the remaining visible columns into any order you wish.

Quicken includes two methods of online access: Direct Connect and Quicken Connect. Both are included in your annual subscription cost, and between the two, I was able to get all but one of my accounts working for online access. (Oddly, that one account did work with Banktivity.)

Why I chose Quicken

Certainly there's some value to continuing with the app I had been using: The import went perfectly, and I felt immediately comfortable in the app. But given how horrid Quicken was for many years of Intuit's onwership, I was prepared to be disappointed.

But Quicken is no longer owned by Intuit—two years ago, they were sold to an investment group. That's both good and bad; it's good that they're out from under Intuit's lack of interest in the Mac app. But it's possibly bad in that an investment group only buys a company for one reason: To later sell it at a big profit.

But to get to the point where the company is worth a higher valuation, they have to offer things that customers want. And to me, it seems "new Quicken" is trying hard. After buying, I received an email thank-you from the CEO, explaining where they've been and where they're trying to go, and thanking me for being a customer—sure, it's a form letter, but it's more than I ever got from Intuit.

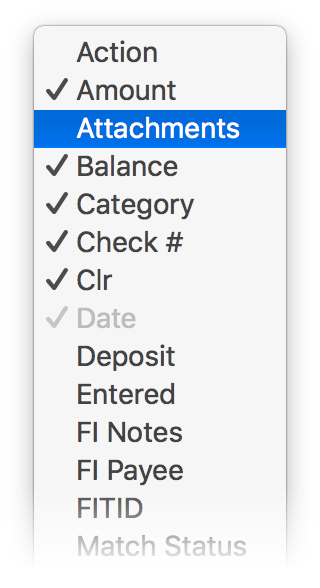

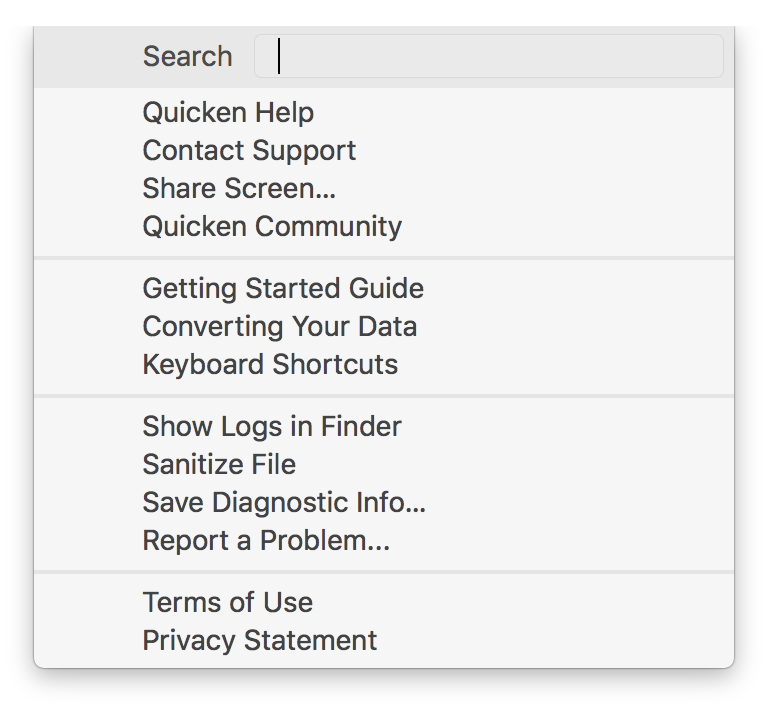

The in-app help options, as seen at right, are extensive and include a link to the community forums as well as an in-app screen sharing feature. The help file itself is detailed and well indexed, making it fairly easy to find what you want. (Though it is a complex app, so there's a lot to look through.)

The in-app help options, as seen at right, are extensive and include a link to the community forums as well as an in-app screen sharing feature. The help file itself is detailed and well indexed, making it fairly easy to find what you want. (Though it is a complex app, so there's a lot to look through.)

The app is a real Mac app, with none of the weirdness that comes from a Java app. Buttons look right, the prefs look right, shortcut keys work as expected, etc.

Finally, there's the issue of cost. Quicken for Mac comes in three versions: Starter ($35/year), Deluxe ($50/year), and Premier ($75/year). The comparison page lays out all the differences. For us, as we need to track loans and investments but don't need bill pay, Deluxe was the obvious choice.

Right now—and probably for quite a while, I'd imagine—a two-year Deluxe subscription is $69.98, bringing the cost per year to $34.99, which is a bargain. By comparison, the first two years of Banktivity would cost us $155, or $77.50 per year. If there are no more discounts after the first two years, Quicken will then cost us $5 more per year than would Banktivity, which means it would take roughly 17 years to spend the $85 we save up front.

Quicken 2018 isn't perfect, but for us, at least, it's a very nice upgrade from Quicken 2007, and its reasonable cost and "not-really-a-subscription subscription" model work well for our family.

Thanks for the review - and the positive experience encourages me to try installing the 2-yr Deluxe version of Quicken that was offered for $44 when bundled with my most recent purchase of Turbotax.

Can you make reports from quicken 2018 like you can from Quicken 2007? I really need the reports for my small business. I still use Quicken 2007.

There's a full Reports menu with seemingly lots of options. I don't do much with reports, however, so I'm not sure if it'll meet your needs.You can create customized comparison reports, summary reports, transaction reports, and there's a selection of pre-defined reports.

-rob.

I used Quicken for 10+ years. Then went to iBank, tried Moneywell. 2 years ago I tried YNAB (You Need A Budget) Hands down the best money app out there. Has totally transformed my relationship to money. Web app from desktop and syncing iOS app.

Wyn:

I'd never heard of them, so thanks for the pointer. However ...

I'm one of "those" people: I despise web apps, and can't use them, and that seems to be what they are now? (Their prior version was a traditional Mac app, it appears.)

Beyond that, if I'm reading the site correctly, all my data is stored on their server somewhere? That's also not for me—I want my financial data on my machine, away from the cloud.

It may be the most amazing solution ever, but those two things will stop me from ever using it.

regards;

-rob.

Thank you Rob for sharing your assessment.

How comfortable are you with sharing all your bank and broker details with Quicken in order to be able to download the transactions? And they even store, at least some of the transactions on their website if you use automated data downloads (Quicken Direct) because they do it overnight and then push it to the client when you connect to the internet with the client.

Posted the last comment not as a criticism of your choice, but to try and understand how you thought about the issue. Thanks.

I’m OK with it, because they’re not storing account access information with that data. I don’t really have an issue if our transaction data got out; I’m much more concerned about the access details needed to get to the data.

-rob.

Thanks for that report. I didn't know that Quicken was not Intuit any longer. I was not able to upgrade to High Sierra with 2007. I too have been using it over twenty years and feared the loss of all that data.

I was using Quicken 2007 in High Sierra; it worked as well as it did in any prior release—take that for what it’s worth :).

-rob.

They are canceling quicken 2007 as of Aug31st

Canceling? They had already canceled updates to it a long time ago. It should still work if you have it installed on your computer.

Thanks Rob for your post here. It steered me in the direction to try out Quicken for Mac 2018 after several attempts to try out the previous versions since 2007 and always going back to 2007. (I always was able to keep all my online investment/billpay features working through High Sierra). I have found that on eBay, 2 year subscriptions are significantly discounted. $70 for 2 year premier and I think $49 for 2 year deluxe.

Nice find on the eBay discounts!

-rob.

I am still using Quicken 2013, manual entries

I bought 14 and 15 uninstalled and threw them out within a couple days

Useless the so-called improvements were of no use to me and it felt like the core program was loosing functionality

Wish I had stuck with 2009 or 2010. maybe earlier

I do not need or want an "app", I want a "program"on my pc only, no cloud and no sync

Retired now, lots of time for manual entries

Ken:

You'd probably be happy with the newer version—it's much more like Quicken 2013, and I've found it quite nice. If you don't like the subscription, you just don't renew when it expires. The app will still work, you'll just lose download ability.

-rob.

Can 2018 still work with qif or ofx for importing if you cancel your subscription?

Their web site says "Monitoring alerts, data downloads, and feature updates are available through the end of your membership term," so that sounds like yes, but I have no way of testing.

-rob.

Hi Rob, thanks for the article. I'm in the same boat as you, needing to reluctantly transition out of 2007 but I DO need the reports function. Like you, I track family spending and finances but depend on the "Income Statement" report every year to send to my accountant. It's a terrific report and I count on it to bring all categorical expenses into one one handy report, and you can even click on each item to reveal the list of underlying individual expenses if necessary. I don't think I could ever do without it. But, I must change to something else, even if it means buying a cheap Windows computer just to run Quicken with all the bells and whistles again. It's a very sad situation for sure.

There's time before resorting to that level of desperation (running Quicken on Windows). Right now, any Mac that can run Mojave can still run Quicken 2007 without really relying on a legacy Mac yet. Assuming "High Mojave" in 2019 has the same requirements, that'll take you until fall 2020.

You are so right about that being a desperate move, to Windows. Yuck. But what leads me to look for other options now is that I can't get my new Discover card to download transactions, getting the dreaded OL-226 error. The Discover rep said downloads don't work with a Quicken over 3 years old. Also, my Schwab stopped downloading a couple of years ago but I like Quicken so much that I've been doing that manually. I need for those to download. And, there's no longer any support, even chat forums, for Quicken Mac 2007. Nail after nail in that coffin, sadly. :-(

I can download Discover .qfx to Q2007. I just have to shorten the file name. I also have to download a .ofx and change it to .qfx and shorten the name on a CitiBank download. Not fast but as long as I can keep Q2007 I'm happy.

Thanks for the heads up on that. I was able to import the downloaded qfx of my Discover statement into Quicken (when importing, it asks what register you want to use to record everything into) without changing the file name.

JC: You can definitely run an income statement, and drill down into details. I'd recommend giving it a try—as a long-time "2007-forever!" user, I've been quite happy with the new (non-Intuit) version. It's updated regularly, and performance is good. They do offer a money back guarantee, as I recall, so you can bail with no cost if it doesn't do what you need.

-rob.

Rob, I didn't realize that an income statement is possible with Q2018. Great! Since the investorjunkie.com site says that P&L / Balance Sheet reports are missing as well as loan amortization, I assumed the Income Statement is missing, too. I will try Q 2018 for sure. I've used Quicken for Mac since 1991 and have been searching for a resolution to the current 2007 issues for quite some time, so your writing here gives me great comfort. Many thanks for that. - Joel

Just to be clear, Quicken is a personal finance tool, not a business tool, so the tools are basic. While there's no balance sheet, there is a net worth report to see assets vs. liabilities. You can also see loan amortization info, though not in as much detail as you could in 2007.

Anyway, make sure the moneyback guarantee is still in place, and if so, give it a try with an import from 2007. I wasn't expecting great things, and while it's still not 2007, it's more than met my personal needs so far.

-rob.

Thanks for that. Did they keep the "Loan Planning Calculator" where you can plug in various interest rates and terms and it'll give you the monthly payments and amortization schedule? Good to know it kept loan amortization -- I'm used to plugging in the loan info and it knows monthly how much of the mortgage payment goes to interest and principle, etc.

Rob - I feel like I just found the lost community of users who love 2007 and can't find a replacement. I purchased the 2018 basic version today. Can you tell be briefly how to get an Income Statement? My use of it is EXACTLY as described by JC -- for 25 years it's been the report I send to my accountant and it works PERFECTLY. Thanks much, Bob

Select Reports > New Report, then Summary type in the dialog that opens. Give the report a name in the new dialog that opens; and for the Rows pop-up, select Categories. For the Columns pop-up, select Time, which will then create a new Interval pop-up; choose the time period you'd like to see, then click Create Report.

This will show all income and expense categories, summed by the time interval you specified. Net Income will be in the TOTAL row at the bottom (i.e. income less expenses).

Once the basic report is onscreen, click Customize to exclude certain categories, or to change the date range to something more useful—I have a saved report set up for Last Year, for example.

Hope that helps;

-rob.

JC - There's a basic "what if" tool, but it's not that advanced—it's about making an extra payment, or what if you want to pay off by a defined date, etc.

-rob.

I still use Quicken Premier 2009 on Win 7. My plans are to upgrade PC w/Win 10 and use Q1018 or 19, but was led to believe that Q2009 could not be readily converted for use with Q2018, but had to be first converted to some intermediate version (2013?), then to Q2018. Is this true? Any other solutions to this situation for satisfactory use with WIN 10?

Is Quicken for Mac 2018 still available? Or is it now 2019? Have used Quicken since 1995 and afraid of change. Stalling around and should buy a new Mac, too, but worried about the Quicken situation.

It's a continually-updated product now, much like Office 365. So it's now Quicken 2019, but anyone who bought Quicken 2018 will now have 2019 as part of their subscription. (If someone doesn't renew, they'll be left with whatever the last version they had before the subscription expired.)

-rob.

Rob, Thank you for the work you have done comparing these accounting software products.. I am sold on Quicken but wondering what version you would recommend for us. We are 1099 contractors in the oil fields of Texas. I need something that will help keep track of deductible expenses.

I wish I had a recommendation for you, but I really don't know - I only have experience with the home version, and I've never used it to do any 1099 tracking.

Sorry!

-rob.

Hi, I've used Quicken 2007 for Mac (and prior versions dating to the early 90's) for my 1099 businesses with fine success. It's very easy to keep track both income and deductible expenses using categories (create categories like "Office Expenses", "Employee Gross Pay", "Business Travel", etc.) and at the end of the year, simply run an "Income Statement" which shows all the expenses totaled you need to see. You can also run a category report which shows each expense itemized. I ASSUME and hope Quicken 2019 uses the same way to keep track of things because you can import your Quicken 2007 file into the new version. I haven't done this yet though I will in the near future. The only things I don't keep track of are equipment and car depreciation -- I leave that stuff to my accountant. Hope this helps.

I thought for sure I was the only one. My current version of Quicken for Mac is the 2007 version and I've been reluctant to try anything newer because my old trusty standby does everything I want and the thought of loading up 25 years of transactions is overwhelming. Everything said here is encouraging. BUT my 2007 Quicken has been running on my Mac Power-PC G-5, not Intel. Can anyone tell me if Quicken data from a power-pc based machine will transport to my Intel-based MacBook Pro?

I've used Quicken since 1992, and the datafile I'm using today has been in use continuously since 2004 through the PowerPC days through Intel on Quicken 2007. Also went through the same transition at work from 2005. Using at home Quicken 2019+ with the same data.

What happens if you disconnect from the internet and try to run Quicken 2018/19? Does the product depend on Quicken servers to function?

You definitely won't get Quicken software updates. Rob quoted the website in a previous comment: “Monitoring alerts, data downloads, and feature updates are available through the end of your membership term". Considering multi year subscription pricing I've found on eBay (if not elsewhere), it's quite reasonable to me to maintain Quicken development for the Mac.

Sorry Brian - reread your question. You can run offline no problem. You just won't be able to download data from financial institutions or get software updates...which shouldn't be a problem since you'll get all that the next time you connect.

Thanks. My concern was if the product required a connection to Quicken servers for activation, basic functionality, etc. In other words, for example, I believe Quicken 2015 is a stand-alone product. It can be installed and used as long as needed even if Quicken goes out of business and any Quicken servers disappear. I think you understand what I meant. I'm still hesitant to "upgrade" to this new version. I think my favorite version was 2012 or something like that. Most of the changes since have been nothing I use and, even worse, annoying when it comes to transaction entry (categories don't auto-fill until more characters are typed, register navigation is slower, etc.). Basically 2015 takes more use of the mouse to enter a transaction whereas previous versions were very easy to use with keyboard only.

I am in the same boat. I've been using Quicken 2007 Deluxe since... well, 2007. It does account ledgers very well and I don't sync to my bank. I'm also upset with Quicken for their new subscription model. One software I've considered which hasn't been mentioned is "Microsoft Money Plus Sunset Deluxe". It's Microsoft's last version of Money (2010) which is available for free without support and they have stripped online banking tools. I know I'd be swapping an unsupported 2007 software for an unsupported 2010 software which is why I keep using Quicken. But, Quicken 2007 had an old look-n-feel in 2007. Just thought this might be relevant to this thread.

I Have used Quicken Premier fon Windows computers or many years and have data entered dating back to the 1990s.

I just bought a Macbook Pro and am worried about the process of migrating data from Windows to Mac.

Please let me know if this will go ok.

Thanks

I don't know how it'll go, having never done it. But they say it works, and they have good tech support, so give it a try and contact them if you have issues with it.

regards;

-rob.

Why won't Quicken 17 not let me install a new copy on my new hard drive? It says I don't have admin rights. I am the only user and am running installation as administrator.

Thanks so much for this information! I was so angry when Quicken went to subscription, I usually buy it every 2 to 3 years and down light that they were taking that flexibility or choice away for me. Do you know if the 2019 version Continues to function For manual entries, etc after the subscription is up?

Thank you for the review. You said you used Quicken 2007 to download transactions, the new Quicken won't do that without a subscription, yet you don't need a subscription to keep using Quicken. It's a deal breaker for me if I have to manually enter about 100 transactions per month or if the price ends up increasing about 500% ($40 once in 2009 vs $40/year going forward) for the new product. How do you use the download functionality without a subscription? Thanks again.

Jane:

My Quicken 2007 wasn't capable of downloading any transactions—I actually wrote "…online access to my accounts was nearly non-existent." Basically, I entered everything by hand.

The new app won't download if I don't renew the subscription. But I worked like that for years, so it wouldn't bother me too much.

The problem with "$40 once in 2009" is that it's not sustainable for any software company—the only way to survive in that model is to continually find new customers, and that's a losing game. I like the new model, where I get new features pretty constantly (there have been at least six updates in the year or so I've been using the new app).

As to renewal costs, I don't know what they'll be as I signed up for two years. I'll let you know in 2020 :).

-rob.

Thanks for this wealth of information. I am another "cult" 2007 user, but I bought 2018 to try on a newer computer. I didn't like it very much but know I will have to throw myself into it to learn it as well as I know 2007. Again, Thanks. I will eagerly follow your link.

Still using 2007 for Mac with El Capitain. Get bank downloads online, stock quotes (portfolio since the early 1990's) and reluctant to change since all works fine. Reports, as some mention, provide data for tax returns. No desire to upgrade.

Rob

I have an old version of quick books but just lost 6 months of data. Thinking of transitioning to something like quicken. Like the auto download feature. We are retired so do not have business anymore. I could just start new this year with quicken but will quicken load my old quick books data?

Dinah

According to Quicken's site, that's not possible:

https://www.quicken.com/support/converting-quickbooks-data-quicken

regards;

-rob.

Not sure why but I was thinking again today that I should explore options to move from Quicken 2007 on our Mac to something more current. I found this posting and didn't realize there were so many of us clinging to that old version but feel better that I'm not alone in the reluctance to upgrade. :-)

The question I have now (being so late to the game) is if I buy Quicken Deluxe 2018 for Mac now will it upgrade me to 2019 or can I prevent that from happening and stay at 2018?

To give some background:

I do not nor have I ever used the online functionality and do not want a version that requires me to purchase a subscription to either use or access my own data on my own hard drive. Though I work in a technology field, I'm rather old school in this manner; I manually enter all transactions in Quicken because I use it as my "sanity check" to reconcile against what our various account holders report online and in monthly statements. By doing this, I can easily spot discrepancies that might need investigating (I've caught errant or fraudulent charges in the past). I also manually input updates to our 401k/IRA and loan accounts when new statements are provided and have no problems doing so since it keeps me apprised of how we're doing with our retirement planning and loan payoffs. I also frequently run quick, one-off reports (Category Detail from the Activities > Reports & Graphs menu) and it sounds like that would still be available in 2018.

Minus dealing with a few display bugs that sometimes require me to close and reopen Quicken 2007 on the current MacOS, it continues to have everything I want or need. But, I know at some point the software will likely stop working. Looking at some comments/reviews where I can purchase 2018 has me worried that I'll be upgraded to 2019 automatically if I install it now. If that's the case, I'll be clinging to 2007 for as long as I possibly can. :-( If anyone can confirm that if I buy a 2018 DVD kit now that I'll be able to stay at 2018, I just might step into the new decade before it ends. ;-)

Laura:

As far as I know, Quicken is only sold via a subscription; there's no such product as the 2018 DVD kit. You buy Quicken 2019 today as a subscription for one or two years. During that time, you'll get each update they release as part of your subscription. If you decide not to renew, whatever the current version is on your Mac is the one that you'll have and use.

-rob.

Thanks for the response. Not sure on rules of posting outside URLs but there's a popular retailer named after a large river in South America that lists "Quicken Deluxe 2018 - 24-Month Membership For Windows & MAC" and the Q&A section says it comes with a DVD of the software but reviewer comments and details are sketchy on whether I could just install from DVD and be done with a few indicating I'll probably be taken to a web site and forced to load 2019. I'm not ready to give up my "free" 2007 for an annual subscription just yet when I don't use the online features and it's not clear if the current and future versions will force me into a subscription just to access our decades worth of financial data.

It's my personal site, list/link whatever you like :). I imagine the DVD is just a way to get to the online installer; they are a subscription-only business. But one of the things I liked is that after the subscription ends, unlike Adobe, etc., you still own the software and it will work, just not the online bits. So whatever version you wind up with it will still work.

My subscription is current, and I'll keep it that way, so I can't tell you how it works post-subscription, but it's supposed to be fully functional except the online stuff.

-rob.

DEAR ROB: WHAT A DELIGHT TO FIND THIS SITE. SINCE I GOT THE NOTICE FROM APPLE THAT AFTER THE NEXT UPDATE THEY WERE NOT GOING TO HANDLE 32 BIT SOFTWARE AND LO, MY 2007 QUICKEN WAS JUST THAT. I WENT TO THE QUICKEN.COM SITE AND PROCEEDED TO START THE ORDER PROCESS. BUT BEFOR FINISHING IT, I READ YOUR ARTICLE AND ALL THE COMMENTS. IT REALLY HELPS TO HAVE MY THOUGHTS REINFORCED AND GET SOME NEW ONES TOO. I DID NOT STRUGGLE WITH SPENDING THE INITIAL AMOUNTS THOUGH. AS YOU GET OLDER YOU HAVE TO LEARN TO TREAT YOURSELF. OF COURSE MY ORDER DID NOT RESULT IN RUNNING THE PROGRAM SINCE I NEED AN ACTIVATION CODE. THIS IS SATURDAY, SO I WILL CALL QUICKEN ON MONDAY AND I'LL PASS ON ANY INTERESTING INFO. I'M ALSO GOING TO TREAT MYSELF TO A NEW MAC. DO. YOU KNOW IF QUICKEN WILL WORK ON APPLES NEW IPAD? THANKS AGAIN

WOW, nice article. For me, stay with MAC OS X 10.12, stay with Quicken 2007 and just go on my way.

thanks for the review & the explanations. I need to "clean" reports (re-allocate costs to different kids/rentals etc). Quicken 17 only produced a category report (which required a huge amount of trial & error); and then you still can't zoom to the individual entry from the the report. Will 2018/19 do this? If not, Really thinking of re-installing 2009 on an older Mac. But I can't to move it from my old old laptop which had the 2009 version. Does anyone have advice on how to move my old Quicken 2009 over to a Mac w/Mojave?

Jamie:

I don't do a ton with reports, but I just ran a Category Summary report, and clicking on any entry in the summary took me to the actual transaction in the specific account. I'd recommend you try it out and if it's not right for you, take advantage of the money back guarantee.

regards;

-rob.

Anyone knows any good financial app to login Chase bank and download account transaction please ? Banktivity, MoneyStrands, Personal Capital, etc.. aren't working any longer... ANY IDEA PLEASE ANYONE OR ANY SUGGESTION PLEASE, You can message on ICQ: @703485525

Hi, I've been a long term quicken user and am also struggling with the updates. I primarily use it for the checking account. I liked 07 for the scheduled transactions, and ease of changing payee details. I do not electronic bank thru the app and reconcile manually has anyone found a good basic checking account alternative.

I didn't like 15, tried to use 17 -- very frustrating.

Thanks so much for the review and info. I am a Quicken user from the 90's as well. I have been using Quicken 2005 and I have been dreading the switch the new version as I am opposed to a subscription as well. All I need is essentially an electronic check book, which is what Quicken 2005 is/was. Thanks again for the review. Much appreciated!

Any suggestions on how to import my data from Quicken 2005 to Quicken 2020??? I tried to but it failed and the Quicken help line could not help. The solution would be to update from Quicken 2005 to Quicken 2007 and then to Quicken 2020. Unfortunately, the company that owns Quicken doesn't have access to Quicken 2007.

Legally? There may be some for sale on eBay and/or Craigslist. Not legally? I'm sure there are versions online, though I've never gone looking for them.

-rob.

Every December I contemplate starting the new year off with a different financial management software and every year I end up staying with Quicken 2007. But here we are once again. Could you tell me if the current version supports these features:

Scheduled transactions

Calendar view of upcoming/past transactions

Loan tracking/payments

Balance forecasts (this is where I startup Quicken now. it shows me my checking balance over the next 30 days based on upcoming transactions)

Automated paycheck transactions (splits your paycheck into the proper fed, state, soc sec, etc deductions)

Download stock quotes without an active subscription

Thank You!

Scott:

I don't know if I can answer all your questions, but I'll try.

✓ Scheduled transactions

✓ Calendar view (customzable)

✓ Loan tracking/payments

? Balance forecasts - I don't know.

? Automated paycheck transactions - I don't know, as I haven't gotten a real paycheck in many years.

X Download stock quotes - this definitely requires a subscription (https://www.quicken.com/support/what-quicken-data-access-guarantee)

-rob.

well... another longtime quicken user here and quicken 2007 refugee. i'm still running high sierra and probably would be OK with mojave to preserve 32-bit support. somehow i'm still able to import certain QFX files into Q2007; there is a new XML-based QFX file that Q2007 does not understand though. for banks that generate those, i end up having to use QIF.

but... quicken 2007 corrupted my data file the other day, and although i was able to restore from a backup, i thought i'd see what quicken 2020 was like.

i feel like it's not much changed from the last time i was tempted by this - 2017 - and i returned to Q2007 immediately back in '17. this time i thought i might have a go at it...

one thing i can't find anywhere in Q2020 is an "income and expense" graph - i like how Q2007 makes 'dual' bar graphs with income and expenses next to one another. in Q2020 all i can see is a "net expense" graph. did i miss it, or does the income and expense graph not exist?

also another thing is i can't seem to figure out how to "find transfer" like in Q2007 - asking to find the transfer for the highlighted transaction simply generates a search for all transfers in the current account... which is not super helpful. can Q2020 actually find and show the matching transfer in the sending/receiving account?

also also, is there really no way to manage autofills for split transactions? paychecks are an obvious place where you end up with repeated splits with the same data in them. if i understand it right, Q2020 just auto-generates a split database which it keeps to itself and then tries to auto-populate transactions with the split info. but i haven't been able to try this yet.

finally, does anyone have any sense of how much stuff is actually stored in quicken's cloud? does the quicken data file actually get uploaded? the 'quicken account' settings seem to show that it knows about the data file and its name, implying that the data file gets sent to their servers.

that's the great thing about Q2007 - it predates all this cloud garbage and it's very unlikely to be spying on you or somehow harvesting data, which i feel is something likely to be happening with Q2020 as it's owned by someone apparently trying to make a big exit.

i wasn't aware that the quicken direct thing ended up pulling your data into their cloud. i really don't like that! i'll try to avoid setting up accounts that way.

thanks for this very informative post and comments section!

(another) rob

Another Rob:

Unfortunately, I can't answer most of your questions, as I don't use or never needed the things you're asking about, so I've never looked for them. Here's what I can say about each:

Income/Expense Graph: I never knew this existed in Old Quicken, so haven't looked for it in New Quicken. All I see is the simple income/expense chart, which you'll find at the top of the Home tab in the main window—there are three graphs there, click the light gray arrows to see each. There are more complicated graph options if you've created a budget, but we don't use Quicken's budgeting tools, so I don't know if it would do an income/expense graph.

Finding Transfers: I don't think this is possible, and note that New Quicken has a new "Transfer" category that they encourage people to use, where it doesn't actually make matching transactions in the other account. I simply hate this, and always use old-style linked transfers, where you enter the actual account the money is moving to. (Because my bank statement will show the transfer in both accounts, reconciling doesn't feel right to just ignore these things.)

Autofills for Split: The latest update says there's a way to do this now, to some extent, but I haven't tried.

Quicken Cloud: Nothing is in the cloud unless you opt in to use it. From their FAQ: "No. The Quicken software program and your data file are installed and stored locally on your computer. If you choose to use the Quicken Mobile app or access Quicken on the Web, you need to enable syncing across platforms by opting in." I have this disabled, so all my data is local.

-rob.

Incredibly helpful article Rob - thanks! Like all others, desperate to move to something more modern, but unlike others NOT because we are Mac users!

We are Windows 10 users and just want something more up to date, supported and mobile friendly now its the 21st century! Again, unlike many others here, I’m more than happy to pay what is frankly a very nominal cost ($70!) per year to continue it working well - that’s frankly nothing compared to its value!!

Questions:

- we’re UK based. Does it still have a default currency option (we’d prefer £ ) that is NOT US $?

- does it still allow separate accounts in another currency eg Euro a d can it convert values to the default still?

- can you use the mobile app on an iPhone if the core app is a Windows one ?

- can you enter transactions on the iPhone mobile app eg (while you’re out and about) and they then update/synch into the ‘main’ app when you get back in front of it?

If yes to those two last elements then it sounds like it really has arrived in this century!!

Huge thanks again

Mike

Mike:

There's a currency option in prefs, though I've never tried changing it. You can also individually change the currency on each account, but I don't know about converting to the default currency.

I've never used the mobile app, but the App Store page for the app says it supports "Quicken desktop" and lists both Mac and Windows, here: https://apps.apple.com/us/app/quicken-2014-money-management/id701067522

That page also says it does the sync thing, but again, I've never used it—note that if you use the Quicken mobile or web apps, your financial data (at least some portion of it) does get uploaded to their cloud server. I don't want that, so I never plan on using the online options.

-rob.

thanks - i will check out the budgeting to see if i can force it to do something like the old I/E graph.

that's terrible news about the transfers. i did notice transfers that looked like "Transfer:[target account]" and thought they had just changed the syntax. unfortunately it seems to have unlinked all the transfers when my 2007 file was imported. so even if going forward i force the old-style transfers, 23 years of linked transfers are gone. worse, in my 529 accounts the sale of shares just shows up as a reduction of value with no transfer at all, and the bank accounts the sales were targeted to have transactions just coming out of hyperspace as an unlinked transfer. i guess that's how it's supposed to work but it is very confusing - no way to know where the money went by looking at the 529 account side.

i see the update notification now, i guess i'll play with it.

thanks for the clarification about the cloud.

wait - i take that back. a right-click on the name/sort bar of the transaction list reveals that "Transfer" is one of the columns available to display. when i toggle that, i see the transfer to the bank account from the 529. there's a little arrow in the transfer column, that when clicked, opens the matching transaction in the other account. this seems to work across account types. who knows why the 'transfer' column is turned off by default! now i need to figure out if this only holds for transactions that were imported from Q2007 or if auto-downloaded transactions which are made into transfers in Q2020 also work this way as well.

I agree 100%. No need to leave my information out there in the cloud for someone to hack!

I just wanted to revisit this thread and provide an update. I ended up deciding to go with Banktivity. I think a lot of the initial concerns Rob had with the version he originally reviewed have been addressed. I've been running it in parallel with Q2007 for about 3 weeks now and there hasn't been anything that I did in Quicken that I couldn't accomplish in Banktivity. I will add that there was a HUGE problem during the import related to stock splits. Basically Banktivity didn't process any of them correctly. I had to manually fix 30 years of stock splits. Also, bond fund transaction were not imported correctly either. This also had to be manually fixed. But after that it was pretty easy to get up and running. There's still a few things I don't like in terms of interfacing with the app; the biggest one is that there is no separate pop-up transaction window. All new transactions get entered into the respective account register. I'll be putting a full list of opportunities for improvement and submitting it to their developers. Hopefully some of the things that will bring it that much closer to Q2007 will get implemented. I'll update here if anything changes.

Comments are closed.